Introduction: Why Saudi Arabia Needs Its Own Cost Guide

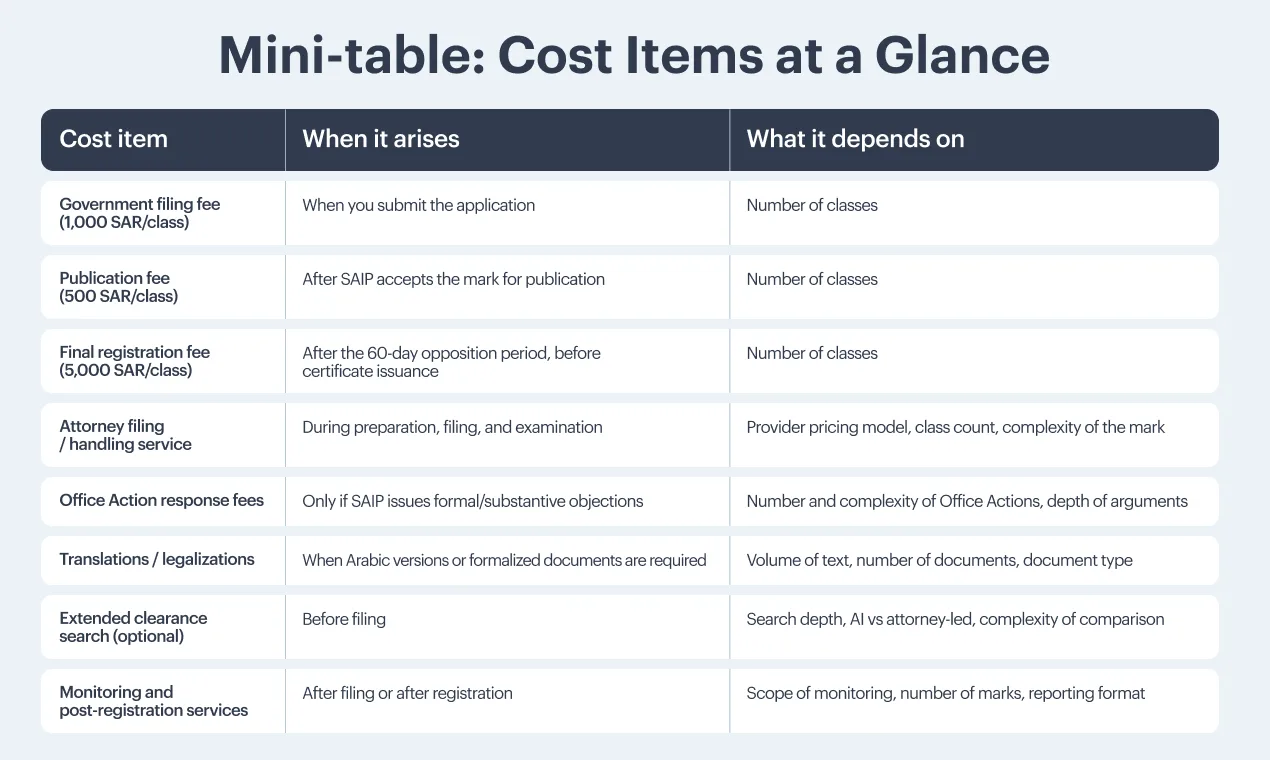

Mini-Table: Cost Items at a Glance

What Influences the Total Budget

“Saudi Budget Traps” and How to Avoid Them

Conclusion: Clarity First, Then Registration

Introduction: Why Saudi Arabia Needs Its Own Cost Guide

On the surface, trademark registration in Saudi Arabia looks straightforward: you file an application, SAIP examines it, the mark is published, and then you receive a certificate. In reality, the final budget often ends up higher than the initial estimate.

The reason is usually not a single “hidden fee”, but a combination of local factors:

- Government fees are charged per class at three different stages: filing, publication, and registration.

- Non-residents must use a licensed Saudi representative, which adds legal service fees on top of official charges.

- The Saudi Authority for Intellectual Property (SAIP) has strict timelines (for example, 10 days to respond to Office Actions).

- Translations and legalizations may be required for powers of attorney, corporate documents, or localized goods/services descriptions.

- Optional but useful steps — clearance search, monitoring, strategy — are sometimes bundled in ways that blur what is essential and what is extra.

This guide focuses specifically on trademark registration costs in Saudi Arabia in 2025. The goal is to: make every cost block visible, show what really drives the budget, and explain how to keep expenses predictable when working with local agents, international firms, or a platform like iPNOTE.

What Forms the Final Cost

Every trademark project in Saudi Arabia is built from four main cost blocks:

- Government fees (SAIP official fees)

- Legal services

- Translations and legalizations

- Optional services (search, monitoring, etc.)

1. Government Fees (SAIP Official Fees, Per Class)

Official fees are mandatory and charged per class at three stages of the process:

Application submission — 1,000 SAR (~270 USD)

Paid right after filing. SAIP will not start examination until this fee is paid. It covers:

- creation of the application record,

- initial data check,

- transfer to formal examination.

Publication in SAIP Official Gazette — 500 SAR (~130 USD)

Paid only after the mark passes formal and substantive examination. It covers:

- publication of your trademark in the SAIP Official Gazette,

- a 60-day opposition period, during which third parties can object.

Final registration & certificate (10 years) — 5,000 SAR (~1,300 USD)

Paid after the 60-day publication period ends (if no opposition is filed). It covers:

- issuance of the official registration certificate,

- 10 years of protection from the registration date.

These three lines are the core of your budget. Any serious quote for Saudi Arabia should show them explicitly.

2. Legal Services

Government fees cover only the state side of the process. All work with documents, strategy, and communication is handled by legal professionals.

For non-residents, using a local Saudi representative is mandatory. Legal service fees typically cover:

- preparing and submitting the application to SAIP,

- structuring and refining the goods/services list under Nice Classification,

- handling SAIP correspondence,

- responding to formal or substantive Office Actions,

- monitoring deadlines and publication,

- coordinating translations and legalizations when required.

Pricing depends on the provider:

- some offer fixed fees per class or per filing,

- others work on hourly billing, especially for complex responses and disputes.

In cost-sensitive projects, it is important to see clearly which part of the quote is SAIP fees and which part is attorney work.

3. Translations and Legalizations

Translations and legalizations are a frequent source of unexpected costs if they were not discussed upfront.

They may be needed when:

- the Power of Attorney must be issued in Arabic,

- the goods/services description needs correction or localization to meet SAIP practice,

- the owner’s corporate documents must be translated or legalized for verification,

- the trademark includes Arabic wording that needs accurate rendering.

According to the process description:

- for non-residents, legalization of documents is mandatory,

- for residents working through an attorney, notarization is required.

While exact translation prices vary by provider, the key point for budgeting is this: every round of corrections or clarifications can generate extra translation and attorney time, which increases the final invoice.

4. Optional Services

Several services are optional but can prevent larger expenses later:

- Extended clearance search before filing

A deeper, attorney-led search that considers identical marks, phonetic similarity, conceptual similarity, and Arabic transliterations. It reduces the chances of refusal, Office Actions, or having to refile. - Post-filing monitoring

Ongoing monitoring of new filings in Saudi Arabia to detect potentially conflicting marks and decide whether to oppose. - Portfolio and class strategy

Especially useful if the company plans multiple filings or long-term expansion in the region.

Such services are helpful, but they should be clearly marked as optional rather than silently folded into a base package.

Mini-Table: Cost Items at a Glance

What Influences the Total Budget

The same official tariff can produce very different final budgets. The main cost drivers in Saudi Arabia are:

1. Number of Classes

Government fees are per class, and each class multiplies:

- 1,000 SAR at filing,

- 500 SAR at publication,

- 5,000 SAR at registration.

Unnecessary classes (“just in case”) significantly increase the state fees and the amount of legal work.

2. Breadth of the Goods/Services List

SAIP expects clear, specific wording under Nice Classification. Overly broad or generic descriptions often lead to:

- clarifications from examiners,

- formal or substantive Office Actions,

- extra rounds of drafting and translation.

In other words, a vague list can make the project more expensive than a narrower, well-structured scope.

3. Office Actions and Oppositions

After filing, the application passes:

- formal examination (1–3 business days),

- substantive examination (30–60 days).

If SAIP raises issues, it issues an Office Action. In Saudi Arabia:

- you must respond within 10 days,

- if you miss the deadline, the application is automatically refused.

Every Office Action triggers additional legal work and sometimes translations. Oppositions during the 60-day publication period also generate extra time and cost, especially if the conflict is complex.

4. Quality of the Pre-Filing Clearance Search

A strong pre-filing search reduces:

- the risk of filing a mark that clearly conflicts with existing registrations,

- the probability of substantive Office Actions,

- the chance of needing a new application (and paying all fees again).

Best practice is a two-layer approach:

- quick AI-based risk assessment,

- followed by a Saudi trademark attorney search for sensitive projects.

5. Need for Translations and Legalizations

When the PoA, corporate documents, or goods/services list need to be translated or legalized, the cost depends on:

- document type and volume,

- number of languages involved,

- whether corrections and re-submissions are needed.

Planning these requirements from the start helps avoid “surprise” translation invoices.

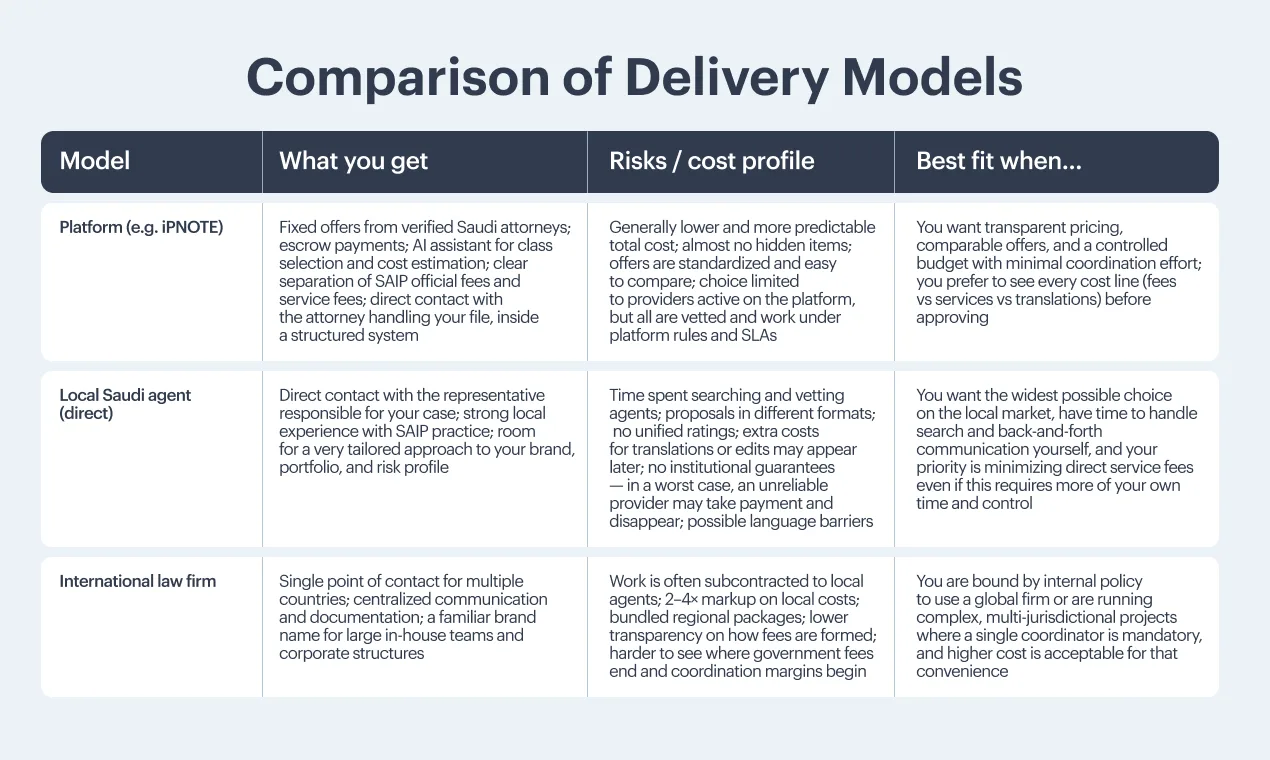

6. Provider Type: Platform vs Local Agent vs International Law Firm

The way the project is coordinated significantly affects the cost structure:

- a local agent may offer lean direct pricing but with less structured budgets,

- an international law firm often adds substantial coordination markups,

- a platform focuses on fixed, comparable offers with clear breakdown.

Understanding these differences is key when comparing proposals.

Comparison of Delivery Models

Below is a practical comparison of how different models typically work for Saudi Arabia.

“Saudi Budget Traps” and How to Avoid Them

Several typical mistakes push Saudi trademark budgets beyond the original plan.

Trap 1: Overly Broad Class Descriptions

Wide, generic lists of goods and services can:

- invite more questions from SAIP,

- increase the chance of Office Actions,

- require multiple rounds of redrafting and translation.

How to avoid it:

Focus on the goods and services that actually matter for your business. Keep the list relevant and SAIP-friendly instead of copying long descriptions from other countries.

Trap 2: No Clearance Search

Skipping a search increases the risk of:

- filing a mark that conflicts with prior registrations,

- receiving substantive Office Actions,

- paying again for a new application after refusal.

How to avoid it:

Combine an AI-based instant check for obvious conflicts and an attorney-led search for sensitive names, descriptive elements, or marks with clear Arabic equivalents.

Trap 3: Automatic or Generic Translations

Using generic or automatic translations for goods and services can:

- fail to match SAIP expectations,

- generate clarification requests,

- lead to extra translation rounds and legal fees.

How to avoid it:

Work with representatives who already use SAIP-aligned terminology and can formulate acceptable wording from the start.

Trap 4: Bundled Packages Without Clear Relevance

Some providers offer:

- “all-inclusive” regional packages,

- monitoring or reporting layers you do not really need right now.

These may be useful later, but they increase the budget if your primary goal is simply registration in Saudi Arabia.

How to avoid it:

Start from a clear, basic objective: register the mark in Saudi Arabia with predictable costs. Add extras only when they support a specific strategy.

Trap 5: No Separation Between Government Fees and Service Fees

A single “all-in” number makes it hard to know:

- how much goes to SAIP,

- how much is attorney time,

- how much covers translations or optional services.

How to avoid it:

Always ask for a broken-down quote at least with official SAIP fees, legal service fees, translations and additional work. This makes comparison and approval much easier.

Trap 6: Missed Deadlines

Saudi Arabia has:

- a strict 10-day deadline to respond to Office Actions,

- a defined 60-day publication period for oppositions.

Missing a deadline can result in refusal or the need to restart the process and repay fees.

How to avoid it:

Use tools or a platform that stores all deadlines in one place, sends automatic reminders, keeps status visible (for example, through an IP Rights card that shows stage, filing date, and deadlines).

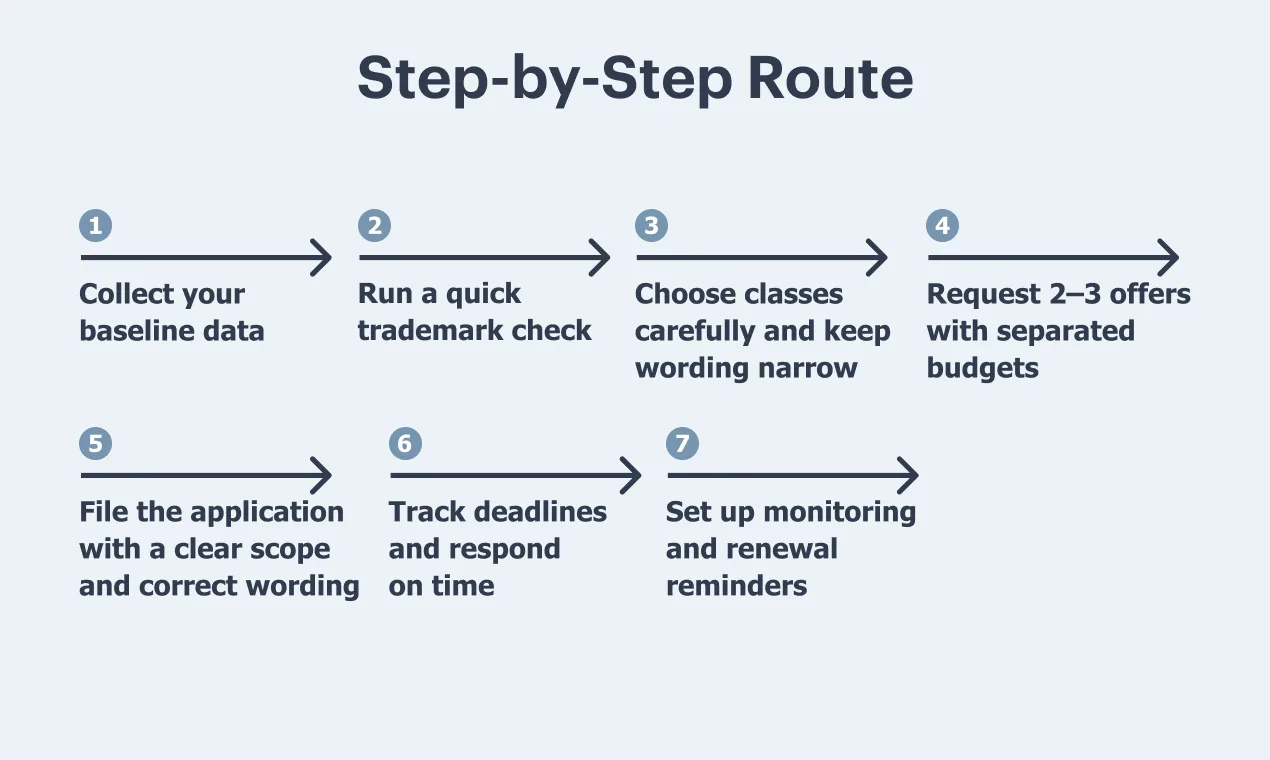

Step-by-Step Route

For a detailed procedural walkthrough, you can follow the full step-by-step guide to trademark registration in Saudi Arabia in the iPNOTE blog. Below is a cost-focused summary of the key stages.

- Collect your baseline data

Prepare the essentials: owner details (name, address, entity type), a clear word or logo file, any priority documents (if claiming priority), and a draft list of goods/services. This helps estimate the budget early and identify translation/legalization needs.

- Run a quick trademark check (Saudi Arabia + Arabic transliterations)

Use an AI-assisted search or a basic database check to spot obvious risks, including Arabic transliterations, phonetic variants, and identical marks. This reduces the chance of objections and extra costs later.

- Choose classes carefully and keep wording narrow

Select only the classes that match your actual business activity. Keep descriptions specific and SAIP-friendly—broad or vague wording often triggers Office Actions and increases the total cost.

- Request 2–3 offers with separated budgets

Compare a platform offer (e.g., iPNOTE) with proposals from local agents or a law firm. Always request a breakdown: government fees, attorney work, translations, and any optional services.

- File the application with a clear scope and correct wording

Once you choose a provider, file through SAIP (directly if you are a resident, or via a licensed representative if you are a non-resident). Your application will proceed more smoothly if classes and descriptions match SAIP practice.

- Track deadlines and respond on time

Monitor formal and substantive examination timelines. Respond to Office Actions within the strict 10-day deadline. Delays almost always increase costs or result in refusal.

- Set up monitoring and renewal reminders

- After registration, enable monitoring for conflicting filings and schedule reminders for the 10-year renewal. This protects your trademark and prevents unnecessary restoration expenses.

FAQ: Short, Practical Answers

Q1: Can non-residents file a trademark in Saudi Arabia without a local agent?

No. Non-residents must file through a licensed Saudi representative. A platform simply makes it easier to find and manage these representatives, but the local agent is still required.

Q2: Do translations apply to Powers of Attorney, corporate documents, and goods/services?

They may. Translations and legalizations are typically required and a transparent provider will explain which documents need translation and why.

Q3: How long does registration take in Saudi Arabia?

Overall, the process usually takes around 3 to 6–7 months, not counting complex disputes.

Q4: What happens after registration?

After registration your mark is protected for 10 years from the registration date, and you need to plan for timely renewal to keep protection continuous.

Conclusion: Clarity First, Then Registration

When you see the full cost structure, as government fees per class, legal services, translations, Office Actions, and timeline effects, trademark registration in Saudi Arabia becomes much easier to budget. The numbers stop feeling random once each expense has a clear reason and stage.

With iPNOTE, you can upload your trademark data, let the AI assistant suggest classes and estimate costs, and then receive fixed, itemized offers from verified Thai attorneys.

If you want transparent pricing, clear timelines, and no hidden fees, create a full-service filing task for Saudi Arabia on iPNOTE and see exactly what your trademark registration will cost before you commit.