Why This Matters Right Now

China remains the world’s largest and most dynamic trademark market.

According to the World Intellectual Property Organization (WIPO), by 2023 the country counted around 46.1 million active trademark registrations, accounting for 42.8 percent of all global registrations by class.

This massive scale creates both opportunity and pressure. Any foreign brand entering China steps into an extremely crowded, competitive environment, where overlapping marks and copycats are common. With so many active registrations, the system relies heavily on non-use cancellations to clear inactive marks.

Under Chinese law, a trademark that has not been used for three consecutive years may be cancelled. For international companies, this creates a dual challenge:

- To defend active trademarks by proving continuous use in China.

- To attack dormant marks that block new filings.

And now, with new 2025 CNIPA guidance tightening procedural standards, both sides must adapt. Preparation, documentation, and consistent use are no longer optional — they are essential.

The Basic Rule That Stays the Same

The foundation of non-use cancellation has not changed.

Article 49 of the Trademark Law of the People’s Republic of China still allows anyone to request the cancellation of a mark that has not been used for three consecutive years without valid reason.

However, while the law remains stable, the practice has evolved. CNIPA is now enforcing stricter filing and evidentiary requirements to reduce abuse and raise overall quality of claims.

What Changed in 2025: A New Entry Threshold for Applicants

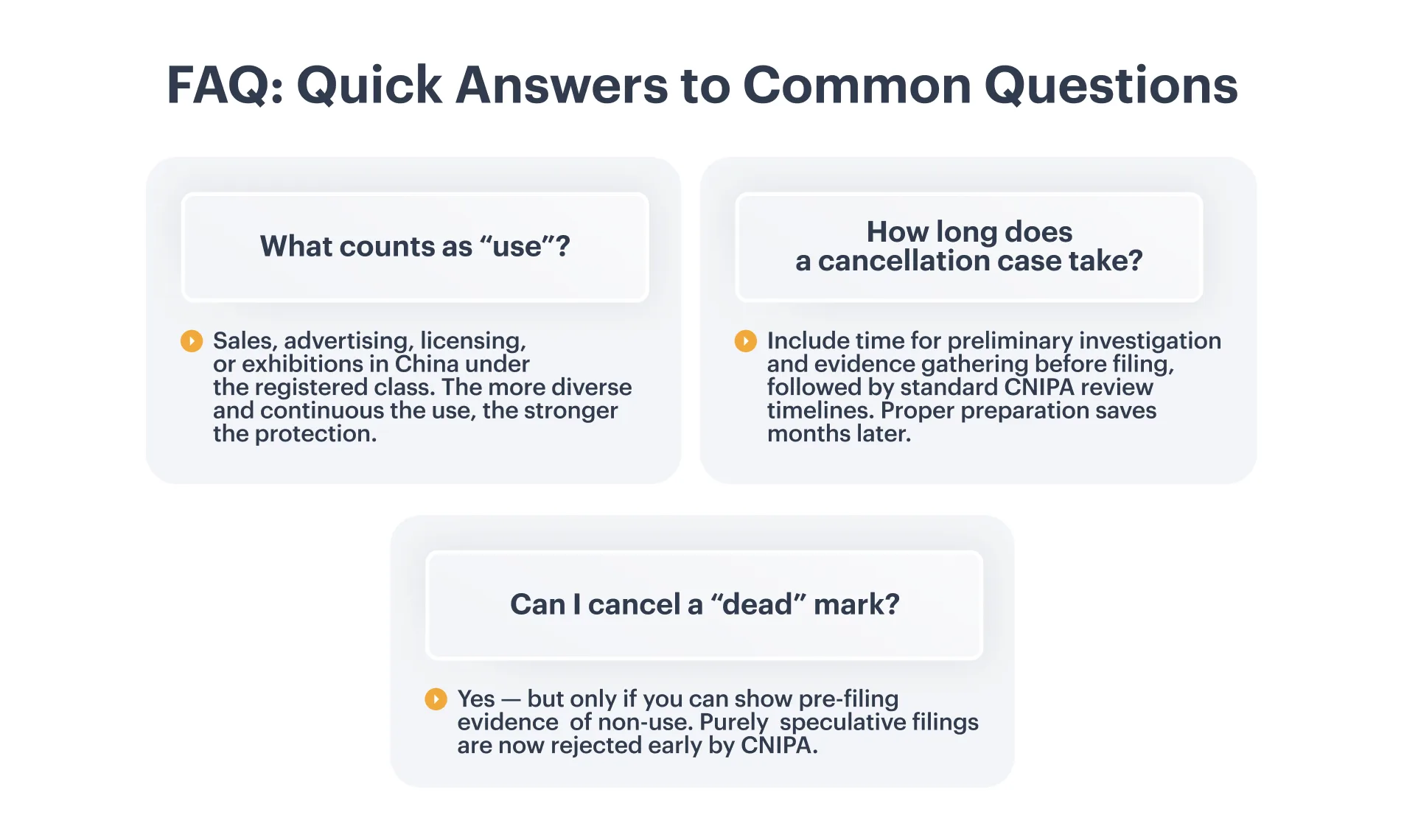

In 2025, the China National Intellectual Property Administration (CNIPA) introduced new procedural and evidentiary standards for non-use cancellation cases. The core three-year rule remains unchanged — any registered mark unused for three consecutive years without legitimate reasons can still be challenged — but the way to start such a challenge has become more demanding.

The key change: CNIPA now requires applicants to provide preliminary evidence of non-use when filing a cancellation request. In other words, filing “blindly,” without any factual basis, is no longer acceptable. Applicants must show that they have already conducted at least some form of investigation into whether the targeted mark has been used in the marketplace.

This includes basic, verifiable materials such as:

- results from online searches or trademark monitoring tools showing the absence of product listings or advertising;

- screenshots from major Chinese e-commerce platforms confirming no active use of the mark;

- findings from in-person checks or “mystery shopping” showing that goods or services under the mark are not available;

- public business information indicating that the registrant has been inactive in the relevant field.

The updated CNIPA guidance, issued between spring and early summer 2025, is part of a broader policy goal — to curb abusive filings and tactical cancellations that flooded the system in previous years. Previously, some applicants used cancellation actions as a low-cost way to pressure competitors or clear the register without genuine evidence. The new framework screens out such speculative cases early, allowing examiners to focus on well-substantiated disputes.

For rights holders, this is a welcome development. The procedural tightening means that brands actively using their trademarks now have stronger protection and are less likely to face opportunistic attacks. On the other hand, for companies seeking to cancel “dead” or dormant marks, the process now involves more work upfront. A proper pre-filing investigation and a solid evidence package are essential before submitting any claim.

In practice:

- Cancellation actions will take longer to prepare and require a higher budget for initial fact-finding.

- Applicants need to plan evidence collection in advance (both online and offline) before engaging local counsel.

- CNIPA’s stricter initial screening means that only credible, well-documented cases move forward.

In short, the new 2025 guidelines reshape the balance between enforcement and protection: it has become harder to attack, but easier to defend — provided the trademark is genuinely in use.

What CNIPA Expects as Preliminary Evidence

The revised CNIPA guidelines make one point clear: cancellation applications can no longer rely on assumptions. Every claim of non-use must be supported by tangible, verifiable evidence collected before the filing date. Likewise, brand owners defending their rights need organized, traceable documentation that proves genuine use in China.

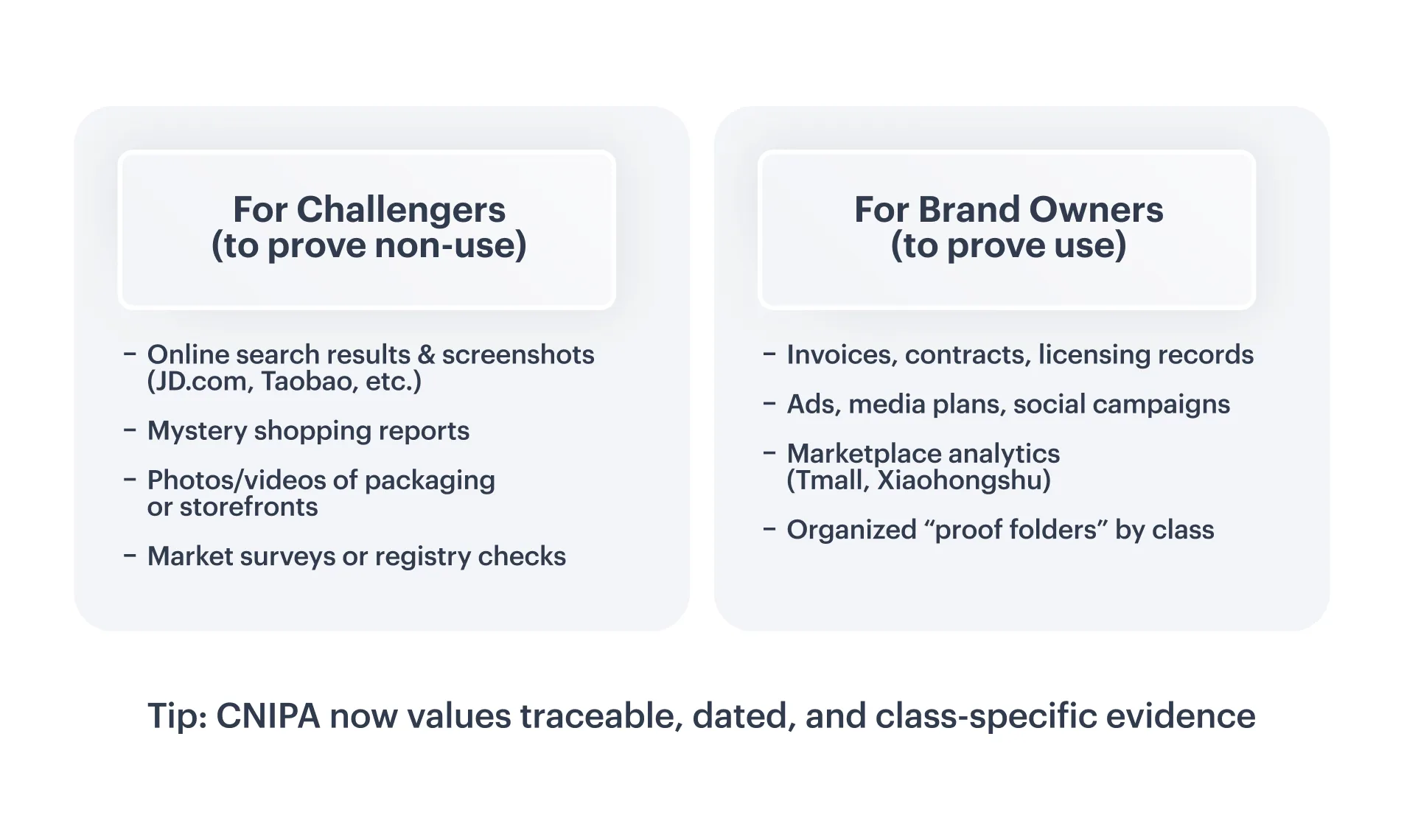

For Applicants Seeking Cancellation

Before filing a request, the applicant must demonstrate that they have already attempted to verify whether the disputed mark is being used in the market. CNIPA now expects to see preliminary evidence that supports a reasonable belief of non-use.

Typical examples include:

- Online search and monitoring results. Applicants can provide screenshots or reports showing that the mark does not appear on major Chinese e-commerce or retail platforms. CNIPA generally expects searches across multiple channels — for instance, Taobao, JD.com, Pinduoduo, and Tmall — covering several consecutive pages and timeframes.

- Investigation reports or “mystery shopping.” In cases involving physical goods, a short investigation in retail stores, distribution outlets, or trade fairs can be valuable. Reports can include dated photos of shelves, purchase attempts, or receipts showing no product available under the disputed mark.

- Photos and videos of packaging, storefronts, or physical outlets. These visual materials help illustrate whether a product line or brand actually exists on the market. When none can be found in relevant regions, this strengthens the claim of non-use.

- Market research or consumer surveys. For service marks or categories with less visible presence, data from surveys or business directories showing lack of awareness or listing can be used.

- Business registry and company information checks. Evidence that the trademark owner’s business is inactive or has suspended operations in the relevant sector can also support a claim of non-use.

Altogether, this type of material forms a “pre-filing fact base” — not yet a full proof package, but enough to convince CNIPA that the claim is legitimate and not speculative.

For Trademark Owners Defending a Mark

On the defensive side, companies must now treat “use evidence” as an ongoing compliance obligation, not something to assemble only when a dispute arises. CNIPA gives significant weight to materials that clearly tie use of the trademark to specific goods or services in the registered classes.

Key categories of proof include:

- Commercial documentation. Invoices, shipping records, contracts, and licensing agreements showing real transactions under the registered mark. These should reference the trademark, goods, or SKUs and cover the relevant three-year period.

- Advertising and marketing materials. Promotional campaigns, media plans, digital banners, social posts, and video ads that display the mark in use — especially those run on Chinese channels like WeChat, Weibo, or local media outlets.

- Sales and operational data. Extracts from sales logs, CRM systems, or distribution databases demonstrating regular commercial activity in China. Date-stamped entries showing continuity are particularly persuasive.

- Marketplace data. Screenshots and sales analytics from online stores or platforms such as Tmall, JD.com, or Xiaohongshu, showing that products bearing the mark were listed, sold, or reviewed during the relevant period.

- Licensing or distribution agreements. If the brand is used through a Chinese licensee or local distributor, include the contracts and any proof of ongoing cooperation, such as invoices or royalty payments.

Each piece of evidence must clearly link the mark, the product or service, the class, and the period of use. CNIPA examiners now pay close attention to whether materials correspond exactly to the goods and services listed in the registration.

The Practical Takeaway

The new regime pushes both sides to prepare better.

For applicants, it means no more “testing the waters” with speculative cancellation filings — each case must begin with documented market research.

For brand owners, it means maintaining evidence hygiene: collecting and archiving materials that prove consistent use, organized by class and year.

Having this information readily available — ideally stored digitally and linked to deadlines in a platform like iPNOTE — can make the difference between keeping and losing rights in China’s crowded trademark landscape.

How This Changes Strategy

The 2025 CNIPA updates shift the balance of effort from post-filing to preparation and prevention.

Both applicants and brand owners now need a more structured, evidence-driven approach. The key difference lies in timing: for those seeking to cancel a mark, most of the work happens before submission; for trademark owners, the work is continuous — maintaining and recording genuine use.

For the Challenging Side: From Quick Filings to Mini-Investigations

Under the new framework, anyone initiating a non-use cancellation must begin with a mini-investigation rather than a simple online search. The CNIPA expects applicants to demonstrate that they have already verified the absence of genuine use, not just assumed it.

Desk research (online phase):

- Review e-commerce platforms such as Taobao, JD.com, and Pinduoduo for any listings under the disputed mark.

- Check Chinese search engines, social media, and business directories to confirm whether the mark appears in current advertising or corporate activity.

- Gather evidence from at least three different online sources, with dated screenshots and URLs, ensuring that each captures both the mark and the relevant goods or services.

Field verification (offline phase):

- Conduct limited physical checks — for example, visiting retail stores, trade fairs, or distributor outlets.

- Take photos or videos confirming the absence of the mark on products, shelves, or promotional materials.

- Commission short “mystery shopper” reports or third-party investigators where access is limited.

Budget and timing:

A proper pre-filing investigation typically adds two to four weeks to the timeline and may involve modest costs for local verification or professional monitoring. However, this investment pays off: CNIPA is now rejecting applications that lack factual grounding. A well-prepared evidence file significantly raises the likelihood that a case will move forward rather than be filtered out at the first stage.

In practice, this means planning the budget for research before filing — not after. Applicants should work with local counsel early, define the classes and scope of goods precisely, and gather enough proof to show that the target mark is indeed inactive.

For Trademark Owners: Building “Usage Hygiene”

On the defensive side, the new rules reward companies that maintain consistent, well-documented use of their trademarks in China.

The best defense is an organized archive of evidence that proves active, ongoing commercial use across relevant classes.

Establishing usage hygiene includes:

- Regular commercial activity: ensure the mark appears on product packaging, websites, invoices, advertising, and e-commerce listings relevant to the registered goods or services.

- Localized marketing: participate in Chinese trade shows, online campaigns, or retail promotions, leaving a visible footprint that can later be verified.

- Sales and advertising records: maintain dated materials — invoices, sales logs, media plans, press releases, screenshots of social posts, or marketplace transactions.

- Class-specific “proof folders”: create digital folders per trademark class containing samples of marketing materials, invoices, contracts, and photos that correspond exactly to the registered goods.

- Periodic audits: review every 12–18 months to confirm that each registered mark still shows evidence of use within the last three years.

In short, CNIPA’s new system rewards preparation.

Challengers must invest in facts before filing, while brand owners must invest in consistency over time.

For both sides, structured data management — ideally supported by platforms like iPNOTE that store, timestamp, and link all relevant materials — is now the cornerstone of success in China’s trademark environment.

Common Mistakes and How to Avoid Them

CNIPA’s stricter rules leave little room for error. Below are the most common mistakes — and practical steps to prevent them.

- Incomplete or irrelevant materials

Provide only evidence tied to the specific class and within the relevant three year period. Keep a short index explaining what each document proves — this helps examiners connect your evidence with the claim. - Foreign-only or non-localized proof

Evidence from outside China (e.g., overseas invoices, global campaigns) carries little weight. Always include Chinese-localized materials — domestic invoices, local ads, Chinese-language web listings, or proof of activity on local e-commerce platforms like Taobao or JD.com. Each file should include visible dates, URLs, and locations to confirm authenticity. - Missed deadlines or incorrect formatting

CNIPA’s 2025 rules are stricter about procedure. Missing a deadline, skipping an attachment, or submitting in the wrong format can lead to rejection. Use a centralized docketing system to track all key dates and have a local Chinese agent double-check compliance before submission. - Weak on-the-ground verification

Many companies rely only on online searches, missing local evidence. For stronger cases, complement online checks with offline confirmations — photos, videos, or market observations from China-based investigators. - No ongoing archive of evidence

Waiting until a dispute arises is risky. Create a continuous “evidence hygiene” system, where every invoice, ad, or campaign screenshot is archived under its trademark and class.

Using a digital IP management platform like iPNOTE helps maintain these records automatically, avoiding panic when a cancellation threat appears.

How International Brands Can Prepare: A Step-by-Step Plan

To stay compliant and protected under the new CNIPA framework, international companies should embed trademark monitoring and documentation into their daily operations. Here’s a practical checklist:

- Audit your Chinese trademarks by class and registration year to identify any marks nearing the three-year threshold.

- Collect and label usage evidence regularly — include dates, SKUs, URLs, and transaction details.

- Create digital “proof folders” for each trademark, containing invoices, ads, sales logs, and marketing data tied to the relevant classes.

- Engage a local Chinese attorney early, ideally before an issue arises, to confirm your evidence aligns with CNIPA standards.

- Set reminders for each mark’s non-use deadline and schedule periodic reviews at least once a year.

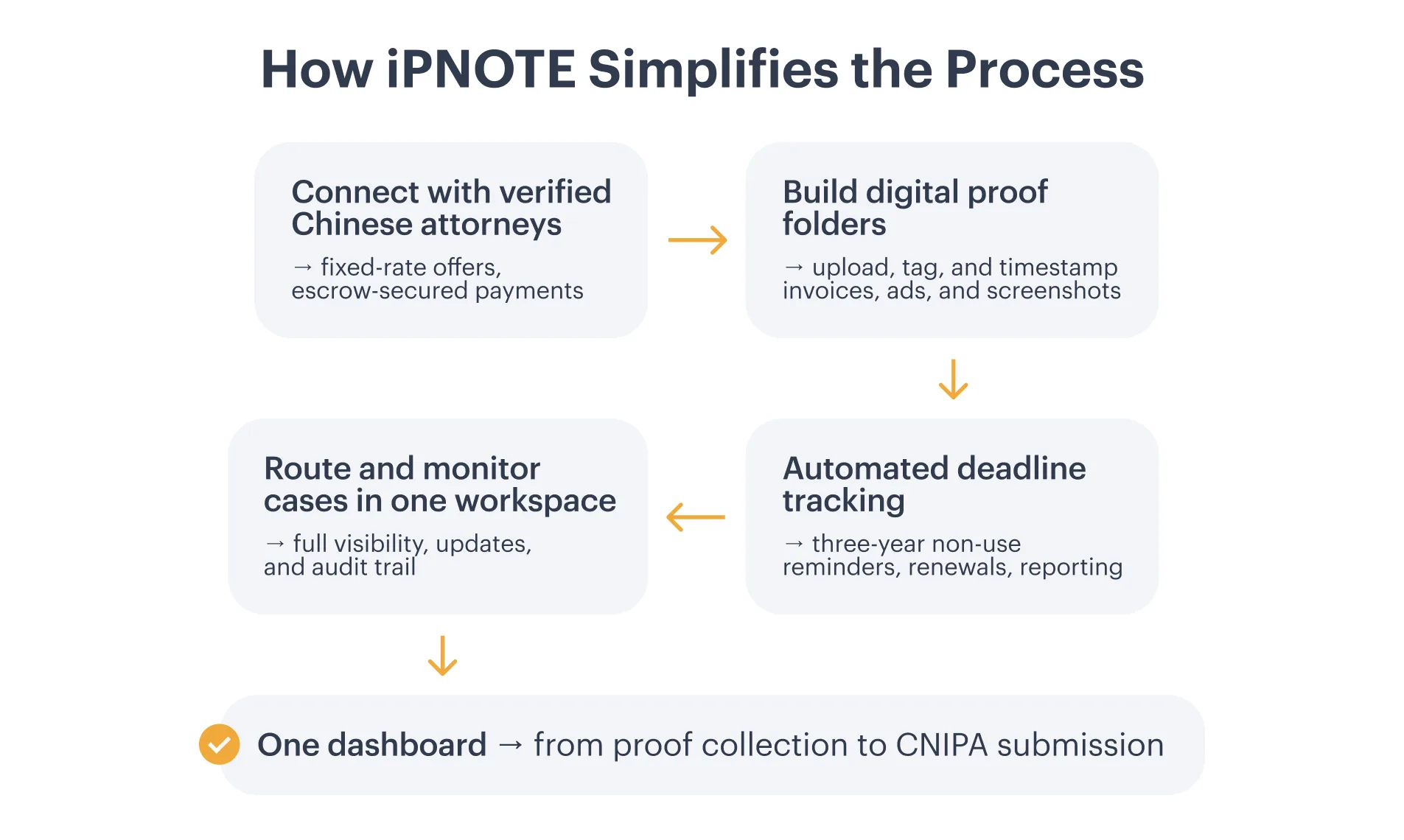

How iPNOTE Helps: Practical Scenarios for Global Teams

1. Quick access to verified Chinese attorneys

The iPNOTE marketplace connects you instantly with licensed trademark attorneys in China. Each listing shows verified profiles, ratings, and fixed-rate offers, so you can choose the right expert transparently. All payments go through escrow, protecting both client and attorney.

No endless email threads — everything from quotes to case files lives in one dashboard.

2. Digital evidence storage and “proof folders”

iPNOTE lets you upload, timestamp, and tag all trademark-related files by brand, class, and country. Invoices, marketing materials, photos, and contracts are stored securely and can be exported as a structured evidence package ready for CNIPA submission.

This eliminates last-minute chaos and ensures every file meets date, format, and localization requirements.

3. Deadline tracking and three-year non-use alerts

The platform automatically tracks non-use periods and sends early reminders before each three-year threshold. Teams have time to refresh campaigns or gather new proof, preventing surprise cancellations.

The same system also tracks renewals and filings across jurisdictions, ensuring total visibility for IP managers and finance teams.

4. Coordinated workflows with local experts

Once the evidence is ready, the platform routes it directly to your selected attorney. All updates, deadlines, and versions are visible in one case record. Managers can follow progress in real time — from submission to CNIPA’s decision — without chasing emails.

5. Compliance and data protection

All data on iPNOTE is encrypted in transit and at rest, backed up regularly, and stored according to data localization and DPA requirements. Corporations retain full ownership of their records and can export everything in open formats at any time — ensuring no vendor lock-in.

In short:

iPNOTE acts as a digital IP department for your China operations — combining automation, local expertise, and security. It helps you defend active marks, challenge dormant ones, and manage every procedural detail under CNIPA’s new stricter standards.

Conclusion: Stay Protected, Stay Prepared

China’s new CNIPA guidelines have raised the bar for trademark compliance and evidence quality.

For global brands, this means moving from reactive to proactive IP management: maintaining continuous records, localizing proof, and monitoring three-year usage cycles closely.

With iPNOTE, this process becomes simple and systematic.

- Review your Chinese trademarks and classes.

- Upload your existing use evidence into iPNOTE.

- Set automatic reminders for each “three-year” checkpoint.

- Connect with a verified Chinese attorney directly through the platform.

Taking these steps today helps you minimize the risk of losing valuable rights — and keeps your brand protected in the world’s most competitive trademark market.