- Introduction: Why Trademark Costs Are More Than Just “a Filing Fee”

- What Trademark Costs Are Made Of: Understanding the Full Structure

- Country-by-Country Cost Breakdown (2025)

- Full Cost Comparison Table

- Budget Traps in Trademark Registration: Do / Avoid

- How to Simplify Cost Calculation and Avoid the “Fine Print”

- Conclusion: Clarity First, Registration Second

Trademark registration in the Middle East is often perceived as a simple government fee. In reality, the final price is shaped by multiple layers, as local trademark agents, translations, publication costs, registration fees, and additional expenses that appear only after the filing.

This guide breaks down the full structure of trademark registration costs in Saudi Arabia, UAE, Bahrain, Qatar, Israel, and Turkey. You will learn how fees work, where brands usually overspend, what to expect in each jurisdiction, and how to reduce expenses using transparent trademark filing services and trademark registration experts through iPNOTE platform.

This is a complete 2025 overview for anyone planning trademark registration in the Middle East, managing an IP portfolio, or comparing IP maintenance solutions across multiple GCC countries.

I. Introduction: Why Trademark Costs Are More Than Just “a Filing Fee”

Many companies assume that trademark registration in the Middle East is a simple equation: pay the filing fee and get protection. But in practice, the final cost almost always turns out higher because:

- government fees cover only a small part of the process,

- local trademark representatives are mandatory for foreign applicants,

- translations into Arabic, Hebrew, or Turkish may be required,

- publication and registration fees are billed separately,

- responses to Office Actions or oppositions add extra costs.

Trademark registration is tied to business expansion, brand protection, ecommerce, advertising, and legal certainty. A trademark is an asset, and like any asset, it requires structured planning and budgeting.

Goal of this guide:

Give you a transparent breakdown of real trademark registration costs across all major Middle Eastern jurisdictions so you can budget confidently and avoid unexpected charges.

II. What Trademark Costs Are Made Of: Understanding the Full Structure

What Trademark Registration Costs Are Made Of And What You Should Expect

Trademark registration expenses in the Middle East generally include:

- Government fees

These are official fees charged by IP offices:

- filing fee

- publication fee

- registration/certificate issuance

- per-class fees

- in some countries — per-item fees (Saudi Arabia does NOT use per-item; Turkey and Israel also do NOT; but Qatar and KSA charge high registration fees)

- Local representative fees

In the Middle East, local attorney representation is mandatory for non-residents in: Saudi Arabia, Bahrain, Qatar, UAE, Turkey and Israel.

These fees usually range $350–$900 per class, depending on the complexity of the filing.

- Translations and legalization

Foreign applicants may need:

- notarized Power of Attorney

- Arabic translation (KSA, UAE, Qatar, Bahrain)

- Hebrew translation (Israel)

- Turkish translation (Turkey)

- legalization at consulates (sometimes required in Saudi Arabia or Qatar)

- Additional expenses

Depending on the country and the complexity of the application, you may encounter:

- responses to Office Actions

- amendments to the application

- oppositions

- late fees

- extra translations

- resolving classification issues

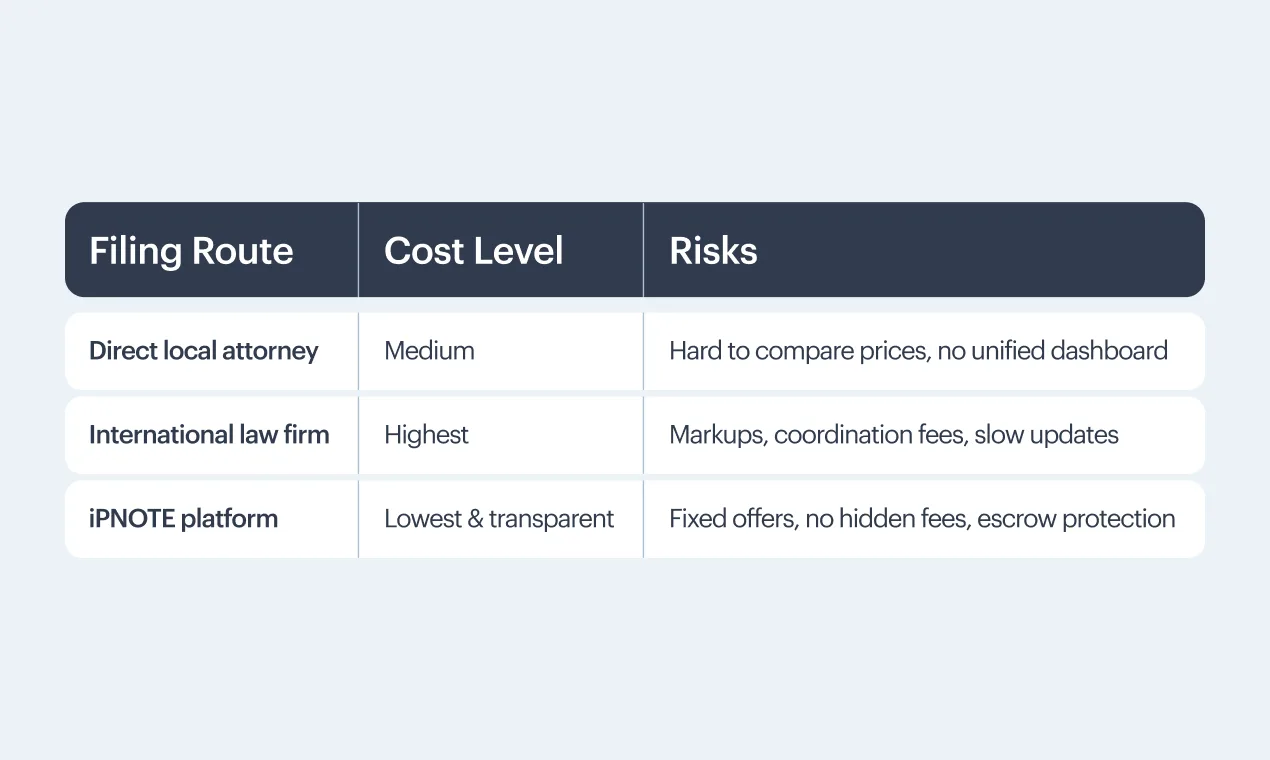

- Filing route

III. Country-by-Country Breakdown

Saudi Arabia (SAIP)

- Filing: 1,000 SAR (~267 USD)

- Publication: 500 SAR (~133 USD)

- Registration (10 years): 5,000 SAR (~1,333 USD)

- Local representative fees

Mandatory for foreigners

≈ 450–600 USD per class

- Extra costs

- POA notarization: 80–400 USD

- Office Actions: 150–500 USD

- Oppositions: 1,500–6,000 USD

Bahrain (BIPA)

- Filing: 100 BHD (~265 USD)

- Publication: 50 BHD (~132 USD)

- Registration: 500 BHD (~1330 USD)

- Local representative fees

Required for foreign applicants

≈ 350–600 USD per class

- Extra costs

- POA legalization: 80–200 USD

- Office Action responses: 100–350 USD

- Oppositions: 500–2,500 USD

United Arab Emirates (UAE / MoE)

- Filing: 750 AED (~204 USD)

- Publication (Official Gazette): 1,000 AED (~272 USD)

- Registration: 5,000 AED (~1,361 USD)

- Local representative fees

Mandatory

≈ 600–900 USD per class

- Extra costs

- POA notarization & legalization: 150–350 USD

- Office Actions: 150–450 USD

- Oppositions: 1,000–5,000 USD

Qatar (IPO Qatar)

- Filing: 1,000 QAR (~275 USD)

- Publication: 500 QAR (~137 USD)

- Registration: 3,000 QAR (~825 USD)

- Local representative fees

Mandatory

≈ 350–550 USD per class

- Extra costs

- POA legalization: 80–200 USD

- Office Actions: 120–400 USD

- Oppositions: 700–3,000 USD

Turkey (TürkPatent)

- Filing: 2350 TL (~55 USD)

- Publication: included in filing

- Registration: 5790 TL (~135 USD)

- Local representative fees

Recommended for foreigners

≈ 180–350 USD per class

- Extra costs

- POA (simple, no legalization): 0–50 USD

- Office Actions: 80–250 USD

- Oppositions: 200–800 USD

Israel (ILPO)

- Filing: 1858 ILS (~570 USD)

- Publication: included

- Registration: 3,148 ILS (~840 USD)

- Local representative fees

Recommended

≈ 400–700 USD per class

- Extra costs

- POA (simple): 0–40 USD

- Office Actions: 150–500 USD

- Oppositions: 800–4,000 USD

IV. Full Cost Comparison Table

V. Budget Traps in Trademark Registration: Do / Avoid

Do — What Helps You Stay Within Budget

Plan renewals in advance

Avoid losing rights or paying reinstatement fees by tracking 10-year renewal cycles per jurisdiction.

Define classes precisely

Narrow, accurate class wording reduces filing fees and prevents costly amendments.

Run a proper clearance search

A structured search (AI + manual attorney review) lowers the risk of refusals and eliminates expenses for Office Action responses and re-filings.

Use verified local attorneys with transparent pricing

Direct access to local counsel through a platform reduces markups and eliminates coordination fees typical for international law firms.

Prepare all required documents early

POAs, translations, and owner data aligned from the start help avoid extra charges for corrections, re-submissions, or urgent processing.

Avoid — What Causes Costs to Spiral

Filing in too many jurisdictions without a strategy

Unnecessary classes and markets multiply fees for filing, examination, and registration.

Ignoring local representation rules

In many Asian countries, non-residents must use a local agent. If this isn’t planned, attorney fees appear unexpectedly.

Choosing broad or incorrect class descriptions

This triggers examiner objections, amendments, and sometimes complete re-filings — each step adds new expenses.

Underestimating translation & legalization requirements

POAs, corporate documents, and goods/services lists often require certified translation or notarization, which adds unplanned costs.

Missing deadlines (Office Actions, fee payments, publication timelines)

Late fees, abandoned applications, and reinstatement attempts can dramatically increase total expenses.

VI. How to Simplify Cost Calculation and Avoid the “Fine Print”

Understanding trademark costs across multiple jurisdictions can feel overwhelming, especially when each country has its own fee structure, rules, and hidden variables. The easiest way to eliminate uncertainty is to rely on tools and workflows that make every expense transparent from the start.

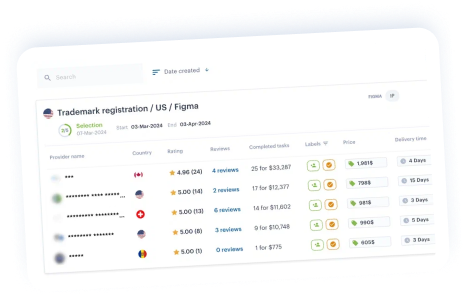

- Use the iPNOTE Cost Calculator and AI Assistant

The iPNOTE platform includes an AI-powered cost calculator that guides you through the entire budgeting process.

It tells you exactly what information is required (classes, goods/services, jurisdiction, expected number of items, POA needs, translation requirements) and immediately generates a clear, itemized estimate.

The AI assistant also highlights:

- which documents you will need,

- which fees are mandatory,

- whether a local representative is required,

- whether translations or legalizations apply,

- where additional costs may arise.

- Transparent, Upfront Estimates (No Hidden Charges)

Every provider on the platform submits a fixed-price offer before work begins.

This means:

- no unexpected add-ons mid-process,

- no hourly billing,

- no “administrative fees,”

- no extra line items hidden in small print.

- Country-by-country recommendations

AI assistant helps you choose classes, jurisdictions, and the right provider.

- Smart Jurisdiction & Class Selection with AI Support

The iPNOTE AI assistant helps you:

-

- choose the most suitable jurisdictions based on your business model,

- determine the right classes (via website analysis or product description),

- refine goods/services wording to reduce the risk of objections,

- select verified local attorneys with proven experience.

This guidance removes uncertainty and ensures the registration strategy matches both your budget and your commercial goals.

Why iPNOTE Helps You Control the Entire Budget

VII. Conclusion: Clarity First, Registration Second

You don’t need to be an IP professional to control your trademark budget.

When all fees are visible and every step is transparent, trademark registration in the Middle East becomes predictable and manageable, even across multiple countries.

Calculate your real trademark cost in Saudi Arabia, UAE, Qatar, Bahrain, Israel or Turkey with iPNOTE and compare offers from verified trademark registration experts.

Start your trademark filing today — get instant cost estimates on iPNOTE.