Introduction: Why Trademark Costs Are More Than Just “a Filing Fee”

What Trademark Costs Are Made Of: Understanding the Full Structure

Country-by-Country Cost Breakdown (2025)

Budget Traps in Trademark Registration: Do / Avoid

How to Simplify Cost Calculation and Avoid the “Fine Print”

Conclusion: Clarity First, Registration Second

Introduction: Why Trademark Costs Are More Than Just “a Filing Fee”

Businesses often expect trademark registration to be a simple, fixed-price procedure. In practice, the final cost depends on several layers: official government fees, local attorney charges, translations, document preparation, responses to examiner actions, and potential disputes.

Many applicants only discover these additional expenses partway through the process, which creates stress, confusion, and budget uncertainty.

This guide removes ambiguity and delivers a transparent, country-by-country cost breakdown for Asia in 2025. You’ll learn exactly what goes into the final price and how to control expenses through smarter planning and platform-based workflows.

What Trademark Costs Are Made Of: Understanding the Full Structure

What Trademark Registration Costs Are Made Of — And What You Should Expect

Many applicants worry about the true cost of registering a trademark in Asia. Most of this anxiety comes from a lack of transparency, because every jurisdiction uses its own fee model, its own document rules, and its own legal requirements.

Why the Final Price Is Often Higher Than Expected

The base government fee is rarely the full story. Extra charges appear because:

- local representatives add their professional fees,

- translations or legalizations may be required for foreign documents,

- amendments, corrections, or responses to Office Actions create new line items,

- some countries charge per item (Thailand, China), while others charge per class.

What the Total Cost Typically Includes

Across Asian jurisdictions, the final amount usually consists of four components:

Government fees

Each country charges for specific steps:

filing,

examination (in certain jurisdictions),

publication,

registration and certificate issuance.

Different structures — per class, per item, per stage — make budgeting tricky.

Local representative fees

In most Asian countries, foreign applicants must file through a licensed local attorney. This is mandatory in Thailand, China, Japan, South Korea, Malaysia, the Philippines, Hong Kong; and while optional in Singapore, it is strongly recommended.

Translations and document legalization

Commonly required for:

- Powers of Attorney,

- corporate documents,

- goods/services localization into acceptable terminology,

- responses to examiner requests in local languages.

These steps ensure compliance with local regulations but add to the overall budget.

Additional expenses

Depending on the country and the complexity of the application, you may encounter:

- amendments (owner address, name, class wording),

- responses to Office Actions,

- oppositions,

- late fees,

- re-filings for rejected classes or items.

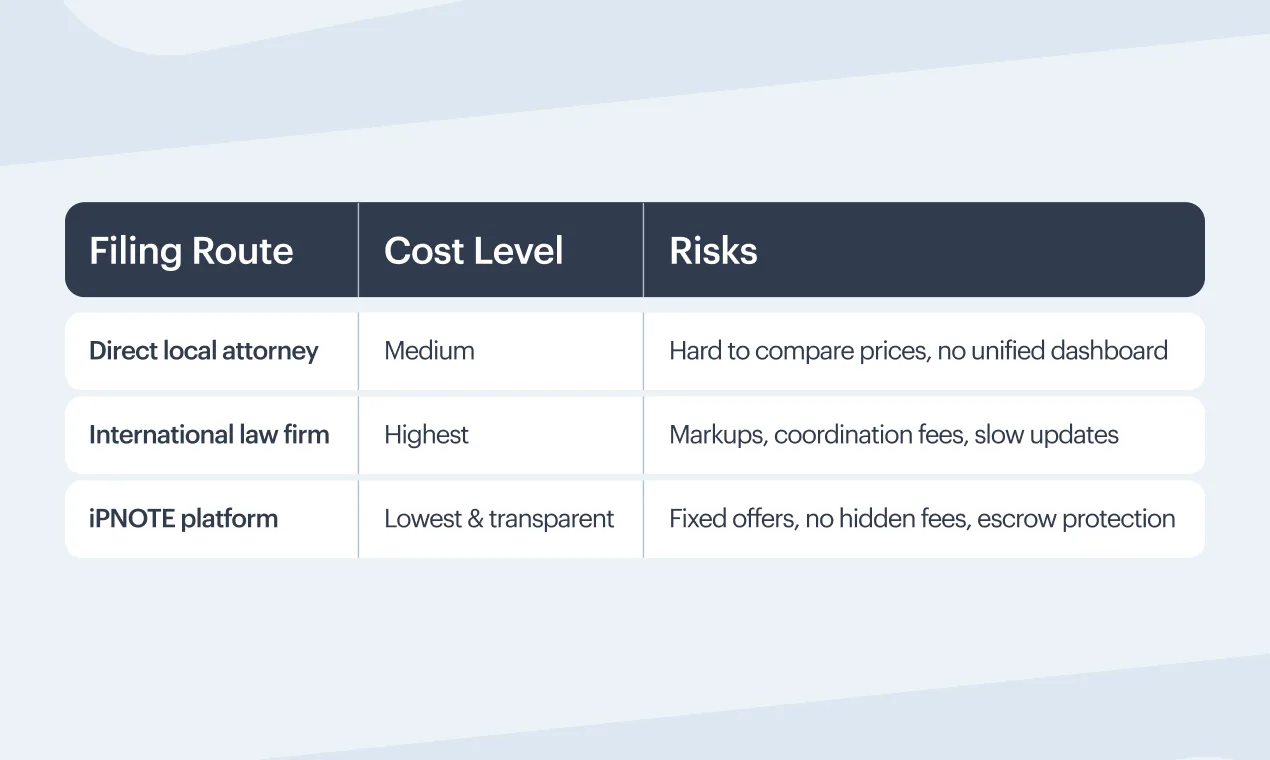

Filing Directly vs. Filing Through Intermediaries

How you file affects the transparency of the price:

iPNOTE removes guesswork by showing the full price before you start, such as government fees, attorney fees, and all additional expenses in one clear breakdown.

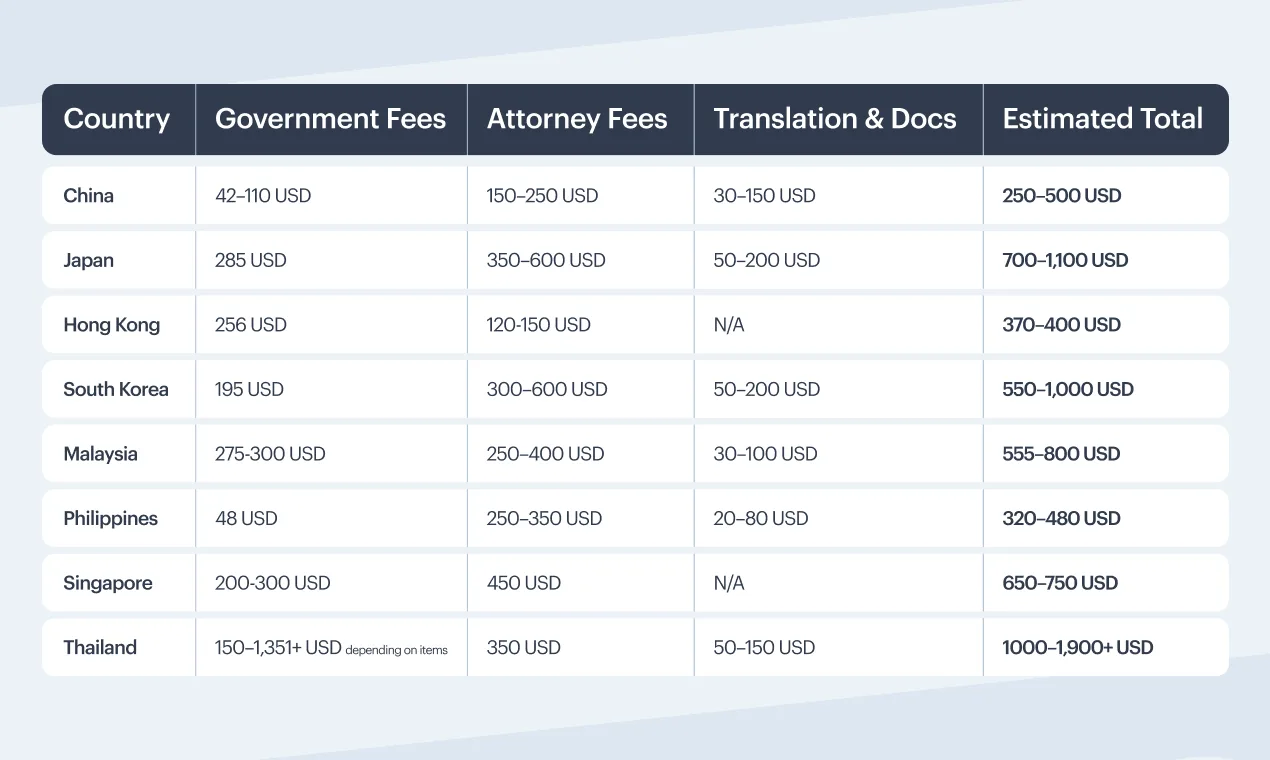

Country-by-Country Cost Breakdown (2025)

Below is a clear snapshot of how much you should expect to pay in each jurisdiction and what drives the cost.

- China (CNIPA)

1.1 Government fees

- Filing fee: 300 CNY per class (~42 USD) for ≤10 items

- Each additional item: 30 CNY (~4 USD)

Registration certificate: 500 CNY (~70 USD)

1.2 Documents, notarization & translations

May be required:

- notarized Power of Attorney

- Chinese translation of applicant data

- certified copies (for priority claims)

1.3 Local attorney fees

Starting from 150–250 USD per class on iPNOTE

(Traditional law firms often charge 500–900+ USD.)

1.4 Additional costs

- Opposition

- Government: 500 CNY (~70 USD)

- Attorney: 250–600 USD

- Office Action responses

- Government: none

- Attorney: 150–450 USD

- Amendments

- Government: 150 CNY (~20 USD)

- Japan (JPO)

2.1 Government fees

- Filing fee: 12,000 JPY per class (~80 USD)

- Registration fee: 32,900 JPY per class (~214 USD)

2.2 Translations

- English → Japanese (goods/services + owner details)

2.3 Local attorney fees

Starting at 350–600 USD per class on the platform

2.4 Extra costs

- Office Actions: 200–600 USD

- Amendments: 50–100 USD

- Opposition response: 400–900 USD

Japan is one of the most expensive jurisdictions due to both government fees and attorney work.

- Hong Kong (HKIPD)

3.1 Government fees

- Filing: 2,000 HKD per class (~255 USD)

- Each additional item beyond 10: 100 HKD (~13 USD)

- Registration: 1,000 HKD (~128 USD)

3.2 Local representative fees

200–350 USD per class on iPNOTE

3.3 Extra costs

- Office Actions: 150–350 USD

- Oppositions: significant, 800–2,000 USD depending on complexity

Hong Kong uses English, so translations are typically unnecessary.

- Singapore (IPOS)

- Filing: 240 SGD per class (~178 USD)

- “Specification per-class” approach: no per-item fees

- Fast-track options available at extra cost

4.2 Local representative fees

Optional but recommended

150–270 USD per class on iPNOTE

4.3 Extra costs

- Office Action: 150–300 USD

- Oppositions: 900+ USD

Singapore is structured, fast, and efficient: excellent for startups entering SEA.

- Malaysia (MyIPO)

- Filing fee: 330 MYR per class (~70 USD)

- Registration fee: 360 MYR per class (~75 USD)

5.2 Translations

Needed for non-English documents

Sometimes needed for POA

5.3 Local attorney fees

250–400 USD per class

5.4 Extra costs

- Office Actions: 100–300 USD

- Amendments: 20–80 USD

Malaysia is one of the more affordable jurisdictions in the region.

- Philippines (IPOPHL)

6.1 Government fees

- Filing: 1,200 PHP per class (~22 USD)

- Online discount possible

- Renewal and publication fees apply separately

6.2 Local representative fees

Required for foreigners

200–300 USD per class

6.3 Extra costs

- Office Action response: 150–350 USD

- Oppositions: 250–500 USD (government fees + attorney work)

- South Korea (KIPO)

7.1 Government fees

- Filing: 62,000 KRW per class (~47 USD)

- Registration: 211,000 KRW (~160 USD)

7.2 Translations

Often required (Korean-language goods/services)

7.3 Local attorney fees

300–600 USD per class

7.4 Extra costs

- Office Actions: 200–500 USD

- Oppositions: 500–1,200 USD

Korea has one of the strictest substantive examinations, increasing the likelihood of Office Actions.

- Thailand (DIP)

Thailand is unique because government fees are calculated per item, not per class.

Filing:

- First 5 items: 1,000 THB per item (~27 USD)

- Items >5: 9,000 THB per item (~243 USD)

Registration:

- First 5 items: 600 THB per item (~16 USD)

- Items >5: 5,400 THB per item (~146 USD)

8.2 Local representative fees

Mandatory for foreigners

≈ 350 USD per class

8.3 Extra costs

- POA translation

- Office Actions: 100–350 USD

- Oppositions: 300–800 USD

Thailand is the easiest country to accidentally overspend if the goods/services list is too broad. You can check the full step-by-step guide to trademark registration in Thailand.

Full Cost Comparison Table

Budget Traps in Trademark Registration: Do / Avoid

Do — What Helps You Stay Within Budget

Plan renewals in advance

Avoid losing rights or paying reinstatement fees by tracking 10-year renewal cycles per jurisdiction.

Define classes precisely

Narrow, accurate class wording reduces filing fees (especially per-item systems like Thailand and China) and prevents costly amendments.

Run a proper clearance search

A structured search (AI + manual attorney review) lowers the risk of refusals and eliminates expenses for Office Action responses and re-filings.

Use verified local attorneys with transparent pricing

Direct access to local counsel through a platform reduces markups and eliminates coordination fees typical for international law firms.

Prepare all required documents early

POAs, translations, and owner data aligned from the start help avoid extra charges for corrections, re-submissions, or urgent processing.

Avoid — What Causes Costs to Spiral

Filing in too many jurisdictions without a strategy

Unnecessary classes and markets multiply fees for filing, examination, and registration.

Ignoring local representation rules

In many Asian countries, non-residents must use a local agent. If this isn’t planned, attorney fees appear unexpectedly.

Choosing broad or incorrect class descriptions

This triggers examiner objections, amendments, and sometimes complete re-filings — each step adds new expenses.

Underestimating translation & legalization requirements

POAs, corporate documents, and goods/services lists often require certified translation or notarization, which adds unplanned costs.

Missing deadlines (Office Actions, fee payments, publication timelines)

Late fees, abandoned applications, and reinstatement attempts can dramatically increase total expenses.

How to Simplify Cost Calculation and Avoid the “Fine Print”

Understanding trademark costs across multiple Asian jurisdictions can feel overwhelming, especially when each country has its own fee structure, rules, and hidden variables. The easiest way to eliminate uncertainty is to rely on tools and workflows that make every expense transparent from the start.

- Use the iPNOTE Cost Calculator and AI Assistant

The iPNOTE platform includes an AI-powered cost calculator that guides you through the entire budgeting process.

It tells you exactly what information is required (classes, goods/services, jurisdiction, expected number of items, POA needs, translation requirements) and immediately generates a clear, itemized estimate.

The AI assistant also highlights:

- which documents you will need,

- which fees are mandatory,

- whether a local representative is required,

- whether translations or legalizations apply,

- where additional costs may arise.

- Transparent, Upfront Estimates (No Hidden Charges)

Every provider on the platform submits a fixed-price offer before work begins.

This means:

- no unexpected add-ons mid-process,

- no hourly billing,

- no “administrative fees,”

- no extra line items hidden in small print.

- Country-Specific Recommendations: Where to Optimize, and Where Not to Save

Trademark costs vary greatly across Asia, and the AI assistant provides tailored optimization tips for each jurisdiction. Examples:

- Thailand: optimize the number of items per class (the main cost driver).

- China: avoid unnecessary subclasses; refine goods/services to reduce Office Actions.

- Japan: descriptive elements often trigger objections — adjusting the mark before filing saves time and money.

- Singapore: multi-class filings are efficient; consider consolidating scopes.

- Malaysia / Philippines: ensure documents are prepared correctly to avoid translation or notarization rounds.

- Smart Jurisdiction & Class Selection with AI Support

The iPNOTE AI assistant helps you:

- choose the most suitable jurisdictions based on your business model,

- determine the right classes (via website analysis or product description),

- refine goods/services wording to reduce the risk of objections,

- select verified local attorneys with proven experience.

This guidance removes uncertainty and ensures the registration strategy matches both your budget and your commercial goals.

Conclusion: Clarity First, Registration Second

Trademark registration across Asia becomes predictable when every cost is visible upfront. You don’t need deep IP expertise to understand the structure, you just need access to transparent numbers, verified providers, and a reliable system that keeps all steps and fees under control.

Get your personalized trademark cost estimate today, compare offers, and choose the best local expert without overspending.

Start calculating your trademark registration costs on iPNOTE and see transparent prices across Asia in minutes.