What is IP box regime?

IP Box Regime (known also as a patent box, innovation box or IP box) is a corporate tax regime used by many countries to incentivize research and development activities by taxing revenues deriving from licenses, royalties, patents, sale or transfer of qualified IP assets differently offering lower taxes compared to other commercial revenues.

Features of IP box regime in Cyprus:

– 80% exemption of qualified profit from exploitation of IP assets (the effective tax rate of 2.5%)

– 0% tax on the gain from disposal of IP assets as a capital nature transactions

– Up to 20 years amortisation period (this in practice can lower the effective tax rate to less than 2%)

– To use these features first of all you need to get qualifying intangible assets.

Qualifying intangible assets comprise of:

– patents, as defined in the Patents Law

– computer software

– utility models, intellectual property assets which provide protection to plants and genetic material, orphan drug designations and extensions of protections for patents

– non-obvious, useful and novel, where the person utilizing them in furtherance of a business does not generate annual gross revenues in excess of €7,500,000, which are certified as such by an appropriate authority, in Cyprus or abroad.

The definition of qualifying intangible assets specifically excludes business names, brands, trademarks, image rights and other intellectual property rights used for the marketing of products and services.

How to get it?

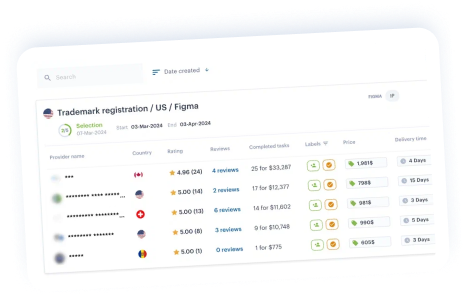

Through the iPNOTE marketplace you can find reliable and trusted providers for IP registration and successful IP box implementation into your corporate structure.

Industrial design in Canada necessitates Canadian design registration for comprehensive protection. With Canadian design registration, businesses ensure the safeguarding of their industrial designs, fostering innovation and competitiveness within the Canadian market.