By Louis Lozouet, Venturini IP

In the past year, Brazil has seen significant developments in tax legislation and foreign exchange regulation that will improve the process of remitting abroad royalties arising from IP contracts, as well as the deductibility of royalty payments.

1. New Transfer Pricing Law

Brazil has enacted a new transfer pricing legal framework. Law #14,596 of 14 June 2023, which entered into force in January 2024, establishes a transfer pricing (TP) framework in Brazil in line with the guidelines of the Organization for Economic Co-operation and Development (OECD).

The new legal TP framework aims at integrating Brazil into the global value chains and mitigate both double taxation and double nontaxation scenarios. In brief, it amends the transfer pricing rules in Brazil by: adopting the arm´s length principle for controlled transactions and broadening the related-party definition, bringing more freedom in the negotiation of contractual conditions between related parties; introducing functional (functions, assets and risks) and economic analysis for applying the new TP documentation rules; introducing the concept of comparability analysis (application of the comparable uncontrolled price – CUP – method, for instance); as well as introducing a modern international tax approach regarding cross border transactions dealing with commodities, intangibles, financial transactions and intercompany business restructuring, among other changes.

In relation to royalties arising from IP and technology transfer transactions, it is worth noting the major changes brought by the new TP model:

- Inclusion of the concept and technical aspects of intangible royalty transactions under the scope of the new TP model;

- Intangibles are normally considered as assets difficult to value and, therefore, would depend on a more individualized analysis of the risks and roles of each party involved;

- The legal ownership of the intangible asset is only a subsidiary element for determining the right to royalties. Therefore, the performance of the so-called “DEMPE functions” (i.e., Development, Enhancement, Maintenance, Protection and Exploitation functions) to determine whether an entity has economic ownership of an intangible asset are considered relevant; and

- The remuneration of the holder of the intangible asset, or other party that is merely responsible for financing the asset, will not exceed the amount determined based on the risk-free interest rate, or the risk-adjusted interest rate assumed.

The impacts of the new TP model on the deductibility of royalties are the following:

- The deductibility of royalties (as well as the remittance of royalties abroad between related parties) is subject to the analysis of risks and functions, associated with the arm’s length principle;

- The Comparable Uncontrolled Price (CUP) method is the main one for analyzing the deductible amount, according to the arm’s length principle;

- Elimination of the need to register contracts with the BRPTO for tax deductibility purposes; and

- Elimination of the deductibility limit of 5% of the gross revenue of the product manufactured or sold using the trademark, patent, or subject to technical assistance, among others that is currently in force in the Brazilian tax framework, said limitation being from now on calculated based on the arm´s length principle. In this regard, according to the current Brazilian tax legislation, contracting parties are responsible for respecting the tax deduction limits established in Ordinance 436/58 dated 30 December 1958. For instance, depending on what is filed, it is possible to deduct between 1% and 5% of the revenue generated by the exploitation of a licensed technology. The same rule applies to the remittance of royalties abroad. There may formerly have been a reason for this limitation, but currently it makes Brazil less attractive to foreign investors.

The TP model will be mandatory for all taxpayers as of 01 January 2024. However, Brazilian taxpayers may opt to adopt it this year by informing Brazilian Tax Authorities (RFB) of their willingness to do so between 1 September and 30 September 30. Check why startups should choose Brazil for IP.

In any case, the RFB is expected to hold a public consultation in the coming weeks, with the objective to gather and publish a set of Normative Instructions that will provide guidance on the new TP regime. A final version of the Normative Instructions should be published in August.

2. New Legal Framework for Foreign Exchange

In addition to the publication of the new law on TP mentioned above, it is worth mentioning law #14,286 of 29 December 2021, published in the Brazilian Federal Gazette on 30 December 2021, with the objective of simplifying and modernizing Brazilian foreign exchange regulation, notably in relation to operations involving Brazilian capital abroad and foreign capital in Brazil.

This new law, which is part of the Central Bank’s innovation agenda, came into force on 30 December 2022. It launched important changes to some of the conditions and limitations related to the remittance of royalties, arising from IP contracts, abroad.

In this regard, two major changes should be highlighted.

First, the registration formalities of IP-related contracts. Typically, an IP contract (e.g., a technology transfer agreement or a patent and trademark license agreement) is registered at the Brazilian Patent and Trademark Office (BRPTO) to:

- be binding on third parties;

- permit the remittance of royalties abroad; and

- allow tax deduction of the amounts paid as royalties.

In other words, the BRPTO’s approval of such agreements is vital not only for Central Bank registration (making overseas remittance of payments feasible), but also for a licensee to classify the amounts disbursed as allowable expenses.

Law #14,286 of 29 December 2021 changes this requirement by establishing that the remittance abroad in the form of royalties, scientific, administrative and technical assistance depends only on proof of payment of income tax. Registering the contract at both the BRPTO and the Central Bank will no longer be required. Additionally, the need to submit proof of validity of Brazilian patents and trademarks and other documents considered essential to ensure remittance of royalties at the Central Bank, as well as company registration, are no longer necessary. Only proof of income tax payment will be required.

Even though the remittance of royalties abroad will be viable regardless of any registration, Law #14,286 of 29 December 2021 does not revoke mandatory registration of IP contracts at the BRPTO for tax deduction purposes. Nevertheless, the new TP model mentioned above eliminates the need to register contracts with the BRPTO for tax deductibility purposes.

Second, the law formerly alters the limits to the amount of royalties to be remitted abroad as established in said Ordinance 436/58 dated 30 December 1958. Indeed, law 14,286 revokes the limits on the remittance of royalties abroad, even when the transaction involves companies from the same economic group (i.e., payments by a subsidiary to its parent company or to a company that holds the majority of the capital of the Brazilian company). Hence, the Central Bank can no longer limit royalty payments to 5% of the revenue generated by the exploitation of a licensed technology, for instance. As previously mentioned, the new TP model eliminates the limits to royalty payments´ tax deduction.

All the changes mentioned above represent significant improvements to the Brazilian tax legislation on royalties arising from IP contracts, particularly given that Brazil is in the process of joining the OECD.

These milestones go beyond tax issues and royalty payments arising from IP transactions as it affects the operating models of multinationals with business in Brazil as a whole. Hence, within this scenario, it is crucial for all multinational companies with presence in the country to identify the effects that these new legislations will have on their business and how to counter them.

***

Need any help with IP matter in Brazil? Contact Venturini IP via iPNOTE now!

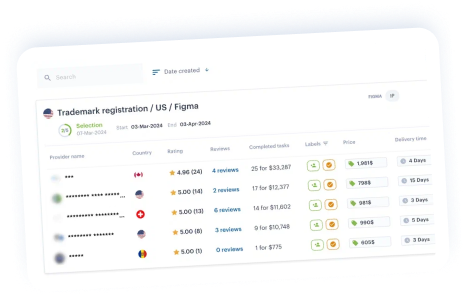

The iPNOTE platform features more than 800 IP law firms that cover more than 150 countries, so you can always find the right direct service provider using our flexible filtering system.

Start protecting your IP with our AI Assistant now.

Check your brand originality with our AI trademark search tool for free!

Sign up for free, and we’ll help you solve any IP-related problem.